Private Equity

MORE THAN JUST CAPITAL

We partner with talented, values-aligned leadership teams to accelerate the growth of companies that are “built to last.” Drawing on our principals’ relationships and experience with building and leading successful companies, we act as advisors to accelerate the growth of each portfolio company and achieve the leadership team’s long-term vision.

Inc. Founder-Friendly Investors Honoree 2021 - 2023

Operating Experience

We partner with leadership teams of companies in industries in which we have relevant expertise and when there is an opportunity to accelerate growth with our experience, networks, and insights through a long-term relationship. Our leadership team has a long and successful track record as founders and CEOs of privately owned and publicly traded companies. We have led rapidly growing businesses at all stages of development and through all business cycles.

Long-Term Perspective

We are business builders who seek to maximize long-term value and create defensible industry leaders. Our evergreen fund structure enables us to hold investments for the long term, and our investor base of business owners, family offices, and foundations serves as a patient source of capital. As a result, our portfolio companies operate without the pressure to accept trade-offs associated with short-term investment horizons and instead seek to optimize outcomes for all stakeholders over the long run.

Conscious Capitalism

We believe that businesses that employ the principles of conscious capitalism generate better returns with lower overall risk. These businesses commit to their mission or purpose and create value for all stakeholders. We believe they are more innovative, less risky, and better positioned to deliver superior performance in the long term because all stakeholders have a vested interest in the success of the business.

INVESTMENT CRITERIA

- Majority investments in businesses with EBITDA of $5 million to $35 million

- Minority investments in businesses with EBITDA of $10 million to $50 million

- Leadership teams that embody the principles of conscious capitalism

- Talented leaders seeking assistance with accelerating their companies’ growth trajectories

- Based in the United States

INDUSTRIES OF FOCUS

- Established consumer brands

- IP- or engineering-driven manufacturing

- Commercial and industrial services

- Health and wellness

PORTFOLIO COMPANIES

-

An operator of high school dropout prevention and recovery programs serving nearly 6,000 students through 19 schools in three states

Based in Orlando, Florida, ALS operates and manages 19 high school dropout prevention and recovery programs (DPRPs) in Florida, North Carolina, and Georgia. ALS provides an alternative learning environment for nearly 6,000 students who have dropped out or are at risk of dropping out.

ALS significantly improves students’ academic performance. During just their first year with ALS, students have achieved an average improvement of three grade levels in reading skills and a nearly 60% increase in total school credits earned. ALS also helps public schools improve their overall graduation rates.

-

A value-added developer and specialty contract manufacturer of custom-formulated nutritional supplements.

Based in Allen, Texas, Formulife is a value-added developer and specialty contract manufacturer of custom-formulated nutritional supplements in powder, capsule, and tablet form for sports nutrition, fitness, and health and wellness brands that sell their products primarily via e-commerce.

Formulife has an outstanding reputation for flavoring and quality. GQ magazine rated one of Formulife’s products “Best-Tasting Protein Powder” in October 2020, and Formulife developed and manufactured 12 of the products recently included in BodyBuilding.com’s top 50 best-selling products. Formulife holds six preeminent industry certifications, including NSF International’s Certified-for-Sport,® Informed Manufacturer, and USDA Organic Certified.

-

Based in Annapolis, Maryland, Hobo is a designer and producer of high-quality branded craft leather accessories in the attainable luxury category, offering an array of stylish and “timelessly cool” leather products at affordable price points. Hobo’s shoulder bags, totes, wallets, belt bags, backpacks, and other leather accessories are sold through major department stores and boutique retailers around the world as well as through e-commerce channels. InStyle magazine described Hobo’s goods as marrying “excellent quality materials with celebrity-approved style.”

-

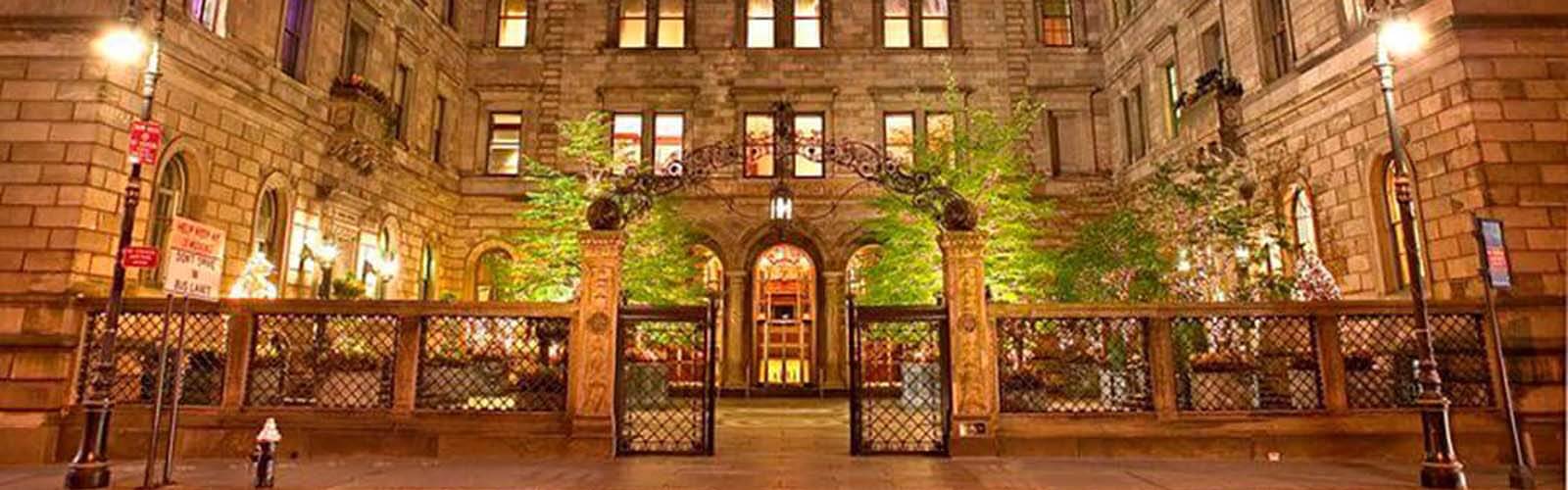

A leading real estate brokerage and investment banking firm with offices in Atlanta, New York, London, and Los Angeles.

With offices in Atlanta, New York, London, and Los Angeles, Hodges Ward Elliott (“HWE”) is a leading real estate brokerage and investment banking firm. Founded in 1975, HWE has completed more than $50 billion in hospitality transactions since inception and has earned a reputation for representing the hospitality industry’s largest and most active owners in completing complex transactions.

Leveraging its relationships, reputation, and expertise, HWE recently expanded its offering to include the sale of real estate assets in industries other than hospitality and to other services, including debt and equity placement. It also plans to add full-service commercial brokerage teams in Los Angeles and Atlanta and to open new offices in Florida, Dallas, and Chicago.

-

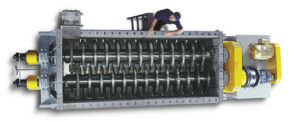

A designer and manufacturer of industrial water filtration and pollution control systems for a diverse group of industrial and municipal customers around the world.

Founded in 1946 and headquartered in Peapack, New Jersey, Komline provides and maintains tailored filtration and pollution control solutions for a diverse group of customers around the world, including municipal wastewater treatment facilities, waste-to-energy utilities, and industrial processing plants in end markets such as chemical manufacturing, food processing, and pharmaceuticals.

Komline prides itself on providing the highest quality equipment and service to solve its customers’ most difficult challenges in wastewater, industrial processing, and flue gas filtration.

-

An omnichannel retailer of specialty furniture products including modular couches (“Sactionals”), Durafoam™ bean bags (“Sacs”), and accessories with a “Designed for Life” philosophy.

Based in Stamford, Connecticut, The Lovesac Company is a designer and retailer of specialty furniture with more than 60 retail showrooms and a bustling online store. Lovesac is a “new economy” company that is disrupting and modernizing the furniture industry by providing sectional couches and durafoam bean bags that are durable, washable, reconfigurable, sustainable, and shippable by FedEx and UPS.

The company’s “Designed for Life” philosophy embraces products that are built to last a lifetime and evolve with customer needs, providing long-term quality to the customer and reducing the amount of furniture that is discarded into landfills.

-

An innovative, tech-enabled provider of land management services with 11 field offices and hundreds of land service professionals and a values-aligned philosophy.

Based in Fort Worth, Texas, Purple Land Management is a tech-enabled provider of land management services with hundreds of professionals in 11 offices across the country.

Purple offers title research, verification, and curative services, as well as lease negotiation, pre- and post-acquisition due diligence, and project and data management to oil and gas exploration and production companies. Purple’s technology platform includes digitized title records, and its proprietary Overdrive software integrates geographic information system (GIS) mapping to manage complex land-management information and provide customers with near-real-time data access.

Purple embraces the principles of conscious capitalism, and its philosophy, “The Purple Way,” reminds all employees to “Give more than you take.”

-

A producer of syrups, sauces, and fruit blends used in coffee, tea, and other hot and cold specialty beverages.

Based in San Leandro, California, Torani is a globally recognized flavor company with more than 150 innovative flavor products, including syrups, sauces, and fruit blends for coffee, tea, and other hot and cold specialty beverages.

Established in 1925, Torani is known for popularizing the Italian soda in the United States and creating the first flavored latte in the 1980s. The company has grown exponentially in the last 30 years, transforming from a family-owned local business to a category-defining market leader, and its syrups and sauces can be found across the United States and around the world, in thousands of cafes and in select retail outlets. Torani is a certified B Corporation with a purpose-driven culture, and its core belief is that businesses can and should create more opportunities for people. The company’s mission is “Flavor for All, Opportunity for All.”

-

A specialty finance company that provides merchant cash advances to lower-middle-market businesses in underserved markets.

Co-Presidents:

James Teppen, Scott WinicourBased in Northbrook, Illinois, Wellen Capital is a specialty finance company that provides capital to lower-middle market businesses in underserved markets.

Wellen provides merchant cash advances in exchange for a share of future revenue. Using clear, simple terms, Wellen advances allow businesses to deploy capital needed for growth without a traditional collateral requirement.

-

An innovative, tech-enabled designer and distributor of branded merchandise and promotional products that embraces conscious practices and principles.

Based in Chicago, Illinois, Zorch is an innovative, tech-enabled designer and distributor of branded merchandise and promotional products for large corporate programs. Zorch’s streamlined service model provides customers with direct access to suppliers, thereby reducing order errors and significantly reducing costs associated with bulk inventory and densely staffed fulfillment teams.

Zorch embraces practices and principles that align with the tenets of conscious capitalism. For example, the company provides an engaging culture for its employees, has been named to the Advertising Specialty Institute’s “Best Places to Work” honor roll, and was named a Top 40 distributor during 2017. Zorch also requires that its suppliers meet a stringent set of criteria which include fair labor practices.

-

Divested June 2020

For more than 30 years, 24 Hour Fitness has been dedicated to helping members change their lives and reach their individual fitness goals. With club locations across the U.S., personal training services, group exercise classes, and a variety of strength, cardio, and functional training equipment, 24 Hour Fitness offers a broad range of fitness solutions. -

A heavy machinery-moving and rigging company that serves customers in a variety of sectors, including manufacturing, medical, semiconductor, and food and beverage.

Divested January 2024

Based in Grapevine, Texas, Able Machinery Movers is a heavy machinery-moving and rigging company that serves customers in a variety of sectors, including manufacturing, medical, semiconductor, and food and beverage.Able was founded more than 60 years ago, and it has developed long-term relationships with a notable list of multinational customers, including Bell Helicopter, General Electric, TDIndustries, Tetra Pak, and Texas Instruments, among others. Able prioritizes completing projects safely, on time, and within budget, and its customers rely on Able’s experience placing machinery in areas with limited maneuverability, as well as its ability to work in sensitive environments such as data centers, clean rooms, and hospitals.

Able’s president, David Krieger, joined the company more than 30 years ago and has developed a culture centered on exceptional customer service, efficient operation, and support for its team members. Able’s workforce is entirely composed of full-time employees rather than contractors, and in Mr. Krieger’s tenure, it has never laid off employees because of changes in workload or project demand.

-

An upscale multifamily and student housing developer, contractor, and property manager with an industry-leading reputation.

Divested April 2022

Based in Austin, Texas, Aspen Heights is a fully integrated, upscale multi-family and student housing developer, contractor, and property manager. Aspen Heights has an industry-leading brand and reputation, with a continual presence on Student Housing Business magazine’s top 10 list of largest domestic student housing owners.

Aspen Heights’ mission — “to cultivate human potential and add value to our world by creating and managing spaces where people live, connect, and learn” — aligns with Satori’s values, as do the company’s community engagement efforts. Through its AH Awake organization, Aspen Heights volunteers time, space, and resources to local organizations, fund-raises for meaningful causes locally and in East Africa, and partners with student and community organizations.

-

Divested October 2015

Based in Andover, Massachusetts, California Products Corporation manufactures environmentally friendly specialty chemical coatings such as tennis court and track coatings, high-end consumer paints and stains, and specialized environmental remediation coatings. CPC generated more than $75 million of revenue during 2013 and plans to grow through acquisitions, geographical expansion, and by capturing market share in select product markets. -

A third-generation family business that provides infrastructure used for large-scale transmission of electricity.

Divested March 2015

PRESS RELEASE: Satori Capital Successfully Divests Its Investment in FWT

FWT is a designer and manufacturer of custom steel monopole towers primarily used in the transmission and distribution of electricity. For over 50 years, FWT has provided quality and innovation that is unrivaled within the global custom steel products industry. From transmission poles to communication towers, FWT offers a comprehensive line of products for the utility and telecommunications industries. The company is a third-generation family business with a commitment to knowledge, innovation, and service. -

A service-oriented distributor of consumable medical supplies primarily to homebound or bedridden Medicaid recipients in Texas.

Divested August 2020

Based in Austin, Texas, Longhorn Health Solutions is a service-oriented distributor of durable medical equipment and consumable medical supplies.Longhorn started doing business in 2005, but the team has been in the medical supply industry since the 1980s. The team surveyed the industry and felt there was a very strong need for a company that focused on treating people with class and respect. They are now serving thousands of clients across Texas through their ten regional branch locations. The company has a “Texas-based, Texas proud” motto and takes great pride in serving fellow Texans with first class service, products, and kindness.

-

A manufacturer and distributor of more than 2.3 billion synthetic wine closures per year that offers environmentally friendly closure solutions to wineries in 47 countries.

Divested April 2021

Based in Zebulon, North Carolina, Nomacorc is a global leader in the manufacturing and distribution of wine closures. Nomacorc provides more than two billion closures per year to more than 5,000 wineries in 47 countries. Domestically, the company’s closures are placed in one of every three wines within the top 500 products by volume.

Nomacorc shares Satori’s commitment to creating value for all stakeholders and employs a partner-centric approach to developing relationships that cultivate a strong and healthy business ecosystem. In addition to deeply understanding and consistently responding to customers’ needs, Nomacorc fosters a culture of technical innovation and is dedicated to offering environmentally friendly closure solutions to winemakers across the world.

-

Divested April 2014

Novaria Group seeks to build a cohesive family of precision component companies, a sum made greater by the value of its parts, that consistently delivers optimum performance and sustainable growth within the aerospace and defense marketplace. Fitz Aerospace is a manufacturer of precision components used in the aerospace and defense sector. Fitz’s manufacturing capabilities are focused on three primary product categories: aerospace bushings, aerospace fasteners, and precision-machined components. -

Divested August 2015

Origami Owl is a rapidly growing designer and direct seller of customizable jewelry. The company’s primary products include lockets, charms, chains, and related accessories. Origami Owl’s stated mission is, “To be a force for good. To love, inspire and motivate people of all ages to reach their dreams and empower them to make a difference in the lives of others.” By providing an opportunity for sales representatives to become entrepreneurs in a flexible work environment, Origami Owl often serves as a springboard for financial freedom, personal growth, and elevated self-esteem that otherwise might have been more difficult to achieve. -

A technology-enabled service provider to the wireless telecom industry that connects roaming wireless subscribers to their provider’s customer service center when they dial 6-1-1.

Divested November 2019

Based in Dallas, Texas, Ranger Wireless Solutions is a technology-enabled service provider to the wireless telecom industry. Ranger Wireless’ patented service connects roaming wireless subscribers to their provider’s customer care center when they dial 6-1-1. As the exclusive dedicated provider of 6-1-1 customer care services, Ranger Wireless serves more than 40 wireless carriers in the United States and Canada and connects nearly 11 million calls each year. Ranger’s services allow carriers to increase customer retention, enhance call center efficiencies and improve end user satisfaction. -

A producer of branded and private-label nuts and dried fruit that serve as significant sources of healthy fats, dietary fiber, and protein.

Divested September 2023

Based in Phoenix, Arizona, SunTree is a producer of branded and private-label nuts and dried fruit snacks including roasted and salted nuts, trail mixes, and chocolate and yogurt-covered nuts. SunTree’s annual revenue has doubled since 2012 from approximately $50 million to more than $100 million.Satori’s investment in SunTree is an example of Satori’s strategy to employ the principles of conscious capitalism and to participate in the shift in consumer demand toward healthy snacks. SunTree serves discerning customers including big-box retailers and national grocery stores.

PORTFOLIO CEOS

Click names to view bios

-

David Brewer

David Brewer co-founded Hobo in 1991 with his wife – Koren Ray, the company’s chief visionary officer and design director – and his mother-in-law. He and Koren took over leadership of the company in 2006.

With a strong focus on supply chain management, operations optimization, and strategic sales growth, David has successfully stewarded the brand through years of sustained growth and significantly increased revenue during his tenure. At the same time, he has created enduring partnerships with banks, suppliers, and employees that have strengthened the company and set the brand apart from others in the industry.

Prior to co-founding Hobo, David developed his entrepreneurial skills in the hospitality industry and traveled extensively around the globe. He speaks three languages and earned a bachelor’s degree in business from the American College in Athens, Greece.

Hobo is now thriving as a second-generation family-run business led by David and Koren. The couple live in Annapolis, Maryland, with their four children.

-

Danai Brooks

Danai Brooks is the CEO of Komline-Sanderson Corporation, a global leader in manufacturing equipment for the water, renewable energy, and other sustainable industries. Prior to Komline-Sanderson, Danai led the successful turnaround and sale of Dyadic, a public industrial biotechnology company, to DuPont. He began his career as an investment banker in J.P. Morgan’s M&A Group, where he led mergers and acquisitions in excess of $40 billion, and in senior operational, engineering, and manufacturing positions at Ford and Dell.

Danai earned a Bachelor of Science degree and a Master of Engineering degree from Cornell University, a Master of Engineering Management degree from Northwestern University, and an MBA from Northwestern’s Kellogg School of Management.

He lives in Washington, D.C., with his wife and twin boys.

-

Bryan Cortney

Bryan Cortney co-founded Purple Land Management in 2010 and serves as its CEO, with a focus on long-term strategy. He is a member of the Young Presidents’ Organization (YPO), has been recognized as a Fort Worth Business Press 40 Under 40 honoree, and has received the TCU Energy Institute “Leader in Energy” award.

Prior to founding the company, he worked in mineral rights leasing, with a focus on the Barnett Shale in North Texas. He is a Registered Professional Landman and member of the American Association of Professional Landmen (AAPL).

Bryan received a B.A. in psychology from Texas Christian University and lives in Fort Worth, Texas, with his wife and children.

“Satori has been instrumental in supporting and investing in leadership development throughout our organization. Its investment in people has not only driven growth for us, but has also preserved and scaled our unique culture.” – Bryan Cortney

-

Melanie Dulbecco

Melanie Dulbecco has led Torani for more than 30 years, overseeing the company’s growth from a family-owned local business to a category-defining market leader. Under her leadership, Torani has increased its revenue every year and expanded distribution to more than 50 countries.

As Torani’s leader, Melanie focuses on nurturing a strong culture, aligning stakeholders around the company’s strategic priorities, and driving growth and innovation. She is passionate about Torani’s “Flavor for all, Opportunity for all” mission and guided the company to become a Certified B Corporation.

Melanie earned a B.A. in economics from the University of California, Berkeley and an MBA from the Stanford University Graduate School of Business.

“We could not have found a more perfectly aligned partner than Satori to help us launch into our next 100 years. They share our values, they are passionate about stakeholder impact, and they bring significant strategic and operational expertise that will help us continue our rapid growth trajectory.” – Melanie Dulbecco

-

Scott Fuhrman

Scott Fuhrman joined Formulife soon after its founding in 2009 and has been instrumental in leading its growth during the last 12 years. He has played a key role in developing its flavoring capability, directing its acquisition of valuable quality certifications, and building long-term relationships with customers.

Scott received his bachelor’s degree in business administration from Southeastern Oklahoma State University.

“We were only interested in partnering with an investor who would embrace our values, help us intelligently expand our production capacity, and share our commitment to quality and service, and we are thrilled to have found that partner in Satori Capital.” – Scott Fuhrman

-

Greg Henry

Greg Henry is Founder and Chief Executive Officer of Aspen Heights. He presided over the development, financing, and construction of more than $2 billion worth of student housing and multifamily real estate in projects nationwide. Under his leadership, Aspen Heights has become one of the premier brands in the student housing industry by delivering innovative products and a unique resident experience.

Prior to founding Aspen Heights in 2006, Greg owned and operated a residential development and construction company in Northwest Arkansas. Greg also teaches entrepreneurship at the highly ranked Socratic Acton MBA program (ranked #1 on Princeton Review’s 2014 list of “Most Competitive Students”). In 2016, he won the Ernst & Young Entrepreneur of the Year Central Texas Award.

Greg received a B.B.A. in marketing from Texas Christian University.

-

William Hodges

Bill Hodges has been involved in all phases of HWE’s development since he co-founded it in 1975. The firm is a fully integrated real estate brokerage and advisory firm historically focused on the hospitality industry, now expanding into all segments of commercial real estate.

Bill has spoken or appeared on panels at the New York University Hotel Investors Conference, Americas Lodging Investment Summit (ALIS), and REIT Finance Conference. He has also been an Entrepreneurial Studies guest lecturer in the Emory University MBA program. Bill holds a B.A. degree from LaGrange College, Georgia, where he has served as a member of the LaGrange College Board of Trustees for more than 21 years (1998-2014, 2015–current) and as Chairman of the Board of Trustees for seven years (2007– 2014). In May 2014, Bill received an Honorary Doctorate of Humanities from the university.

-

David Krieger

David Krieger joined Able more than 30 years ago and has overseen day-to-day operations of the company since 1988. Under his leadership, the company’s revenue has compounded by more than nine times.

As Able’s leader, David has developed a culture centered on exceptional customer service, efficient operation, and support for the company’s team members. Able’s workforce is entirely composed of full-time employees rather than contractors, and in David’s tenure, it has never laid off employees because of changes in workload or project demand.

Prior to joining Able, David worked for Electronic Data Systems. He has a bachelor’s degree in business from the University of Nebraska at Kearney.

“Satori understands the value of what we’ve built, and they’re helping us grow the right way…. We couldn’t ask for a better partner than Satori.” – David Krieger

-

Shawn Nelson

Shawn Nelson founded Lovesac in 1998 and serves as Chief Executive Officer of the company. He is the lead designer of the company’s patented products and leads sourcing, creative, design, public relations, investor relations, and culture.

Shawn received the Ernst & Young Entrepreneur of the Year Award in 2003. In 2005, he appeared on and won Richard Branson’s television show “The Rebel Billionaire” on Fox and continues to participate in ongoing TV appearances.

Shawn received a B.A. in Chinese from the University of Utah and has a master’s degree in strategic design and management from Parson’s, The New School for Design NYC, where he is a graduate-level instructor. He is fluent in Mandarin. Shawn lives in Utah with his wife and four children.

“Satori’s long-term perspective, operating expertise, and commitment to conscious capitalism accelerate our ability to fulfill our mission.” – Shawn Nelson

-

James Teppen

Jim Teppen has more than 20 years of experience in the financial services industry. He initially joined Wellen — then called Gibraltar Business Capital — as Chief Financial Officer before being named Co-President and then President of Gibraltar Cash Advance. Previously, he served in Ernst & Young’s Financial Services’ performance improvement advisory practice, where he drew on his specialty in finance management to assist banking and capital markets companies with risk and performance improvement. Prior to Ernst & Young, Jim held accounting and finance roles at both ABN AMRO and Transamerica Commercial Finance.

Jim received his B.S. in accountancy from the University of Illinois at Urbana-Champaign. He is a certified public accountant (CPA) and a chartered financial analyst (CFA) charter holder.

“Satori consistently gives us strategic focus, tools and techniques to understand our competitive landscape as well as the real value we bring to all of our stakeholders. They are helping us break through to be next-level industry and team leaders, while we work smarter, not just harder.” – James Teppen

-

Angela Whitford-Narine

Angela Whitford-Narine joined ALS in 2002 and has served as its president or CEO since 2014, overseeing all aspects of school operations and performance as well as public relations, legislative initiatives, and communication with community stakeholders. She directed the company’s expansion into two new states as well as the opening of more than 15 schools. Under her leadership, all ALS schools in Florida achieved a “commendable” rating from the Florida Department of Education, the highest possible rating.

Prior to her role as CEO, Angela gained a broad perspective on the business by serving in roles at ALS such as Regional Director of Schools and Assistant Principal of Curriculum and Instruction, where she directed school leadership, designed and implemented student achievement benchmark testing programs, and launched enrollment expansion and professional development programs. She is also a former instructor with a deeply held commitment to improving students’ lives and access to education.

Angela received a B.S. in psychology from Hamilton College and an M.S. in clinical social work from the University of Central Florida.

-

Mike Wolfe

Mike Wolfe has served as CEO of Zorch since 2013, where he has led the expansion of Zorch’s prominence in the branded merchandise industry, as well as the company’s sale to Satori Capital in 2018. Prior to joining Zorch, he was Executive Vice President for global moving and relocation services company Sirva, providing overall strategic direction and operational leadership for the $1 billion Global Moving Services division. Previously, he held a variety of progressive financial positions since beginning his career at PwC.

Mike holds a B.B.A. in accountancy as well as a B.B.A. in finance and economics from the University of Notre Dame and is a Certified Public Accountant. He is married to his wife of 25 years, Carrie, and has two daughters.

OPERATING PARTNERS

Investment Sourcing, Diligence Assistance, Sector Expertise, Portfolio Company Advice

Click names to view bios

-

Eric Bennett

Eric Bennett has more than 30 years of experience in wealth management, investment management, and philanthropy. He co-founded Tolleson Wealth Management, a single family office that transformed into one of the largest and most reputable multi-family offices in Texas. Through this process, he was also integral in creating a private bank, a trust company, and philanthropy arm. Eric was at Tolleson for 16 years (1998-2013) and was Chairman and CEO of Tolleson Private Wealth Management, as well as Chairman of the Investment Committee. He continues to serve on the Board of Directors for Tolleson Private Bank and Tolleson Wealth Management.

In 2013, Eric had the opportunity to become the founding Executive Director of the Brain Performance Institute at the Center for BrainHealth. The Brain Performance Institute translates proven science, developed at the Center for BrainHealth, to the public. Eric was an active volunteer at the Center for BrainHealth for 10 years and joined full time in this leadership role to build and grow the Institute. Under his direction, the Institute substantially increased visibility and credibility in the community, launched a successful capital campaign for an iconic new building that opened in 2017, and built and led a team to provide vital services to enhance brain health in groups including schools, the military, and athletes. He left his full-time position there after three years, yet continues to be an active supporter.

He began his career with PriceWaterhouseCoopers in 1987 after earning a bachelor’s degree in finance, with honors, from the University of Missouri. He later joined Ernst & Young, where he served as Senior Manager of the Personal Finance Planning Group and led the firm’s Southwest Area Investment Advisory Services team.

Eric is a Chartered Financial Analyst (CFA) and Certified Public Accountant (CPA). In the community, he serves on the Board of Directors for the Planned Giving Councils for Children’s Medical Center and Communities Foundation of Texas. Eric serves on the investment committee for the Baylor University Endowment. He is also a member of Young Presidents’ Organization (YPO), having served on the executive board of his YPO chapter for four years. He formerly served on the investment committees for the Dallas Symphony Foundation and Communities Foundation of Texas.

Eric married his wife, Robin, in 1991. They have two children, Samuel (1996) and Emily (1999), and live in University Park, Texas. They also have two dogs, Goldie and Max.

-

Wes Blair

Wes Blair is Satori Capital’s executive coach in residence.

Wes assists business leaders in transforming their companies “from scrambling to scaling” by unlocking their general management and leadership capacity. He typically works with chief executive officers and owner-operators willing to embrace sustained change programs to achieve breakthrough performance improvement for all stakeholders.

Wes introduces proprietary tools and templates that enable executives to effectively implement and sustain new operating models. Areas of focus include organization and talent design, recruiting plans, compensation plan design, initiative prioritization and execution, scaling systems and processes, and many others. Leaders typically report a successful shift from the need for daily heroics to a more impactful focus on the business’s most strategic issues they are uniquely qualified to address.

Wes has significant experience operating small and large businesses in both challenging and rapid-growth environments. He was president of private equity-sponsored industrial equipment company PrimeSource and a division president of a $1 billion publicly traded airline during its successful turnaround. Earlier in his career, he participated in the turnarounds of Continental Airlines and Dell Computer. He was also a manager at Bain & Company.

Coaching relationships have included multi-year engagements with First United Bank and driversselect (now a part of Sonic Automotive) that resulted in exponential scaling and meaningful cultural advancement. At Satori, Wes has worked with Able Machinery Movers, Accelerated Learning Solutions, Formulife, Hobo, Lovesac, Purple Land Management, and SunTree Snack Foods.

Wes graduated magna cum laude with a degree in mathematical economic analysis from Rice University. He lives in Dallas with his wife and three sons.

-

Vic Keller

Vic Keller is a senior executive at Berkshire Hathaway Automotive and is the founder of the ZAK Automotive Companies.

Vic began his career with JP Morgan in commercial banking, where he partnered with several mentors who invested in his early development, equipping him to earn the coveted top performance achievement award in his first year of employment. He then began his career in the automotive industry as an executive with Wynn’s International in its oil and insurance subsidiary, Wynn’s Automotive.

In 2002, Vic started his first company, carXperience, and after one year partnered and grew the business with automotive industry icon Cecil Van Tuyl. Over the past 15 years, Vic has launched several companies, all which vertically integrate into the automotive industry. His current enterprise, ZAK Automotive Companies, includes ZAK Products, ZAKTEK and NEXEMO. ZAK Products offers franchised automotive dealerships a comprehensive line of professional-grade fluid maintenance products combined with industry-leading training. ZAK Products is an official partner of NASCAR and is designated as the #1 Professional Maintenance Fluid of NASCAR. ZAKTEK is an interior and exterior paint insurance protection program sold exclusively within franchised car dealerships, and NEXEMO is a B2B e-commerce purchasing platform for the automotive industry. Collectively all of these companies continue to earn double-digit growth year over year and have been recognized by Inc. 500/5000 as one of the fastest-growing privately held companies in America in 2013, 2014, and 2015. In March of 2015, Vic successfully sold all of the ZAK Automotive Companies to Berkshire Hathaway.

While Vic remains involved in a leadership capacity in these companies, his role as a senior executive for Berkshire Hathaway Automotive provides him the platform to implement his entrepreneurially driven culture and strategy within a fortune 500 company. Berkshire Hathaway Automotive is a $10 billion company with 11,500 associates and, as Mr. Buffett has noted, is destined for significant growth under his ownership.

The Automotive Aftermarket Industry Association (AAIA) awarded Vic the 2011 Impact Award, recognizing his contributions as an automotive industry executive. Vic has been a finalist for the EY Entrepreneur of the Year, Southwest Award in 2015 and 2016. He is a graduate of Texas Tech University.

-

Craig Lentzsch

Craig R. Lentzsch is a senior corporate executive with significant experience in the transportation sector. He has held chief executive officer, president, executive vice president, vice chairman, and board of directors positions for Coach America Holdings, Inc., Greyhound Lines, Inc., Dynamex, Inc., the National Surface Transportation Infrastructure Financing Commission, and the Intermodal Transportation Institute at the University of Denver.

Craig served until 2007 as president and chief executive officer of Coach America Holdings, Inc., a former portfolio company of Kohlberg & Company, LLC. With 30 business units located in all major cities in the southern half of the United States, Coach is the premier provider of ground transportation and travel services in its markets. During his tenure, the company’s revenues increased from $200 million to more than $400 million.

Prior to Coach America, Craig served on two different occasions at Greyhound Lines, Inc. Greyhound, publicly traded during Craig’s tenure, is the only nationwide provider of intercity bus transportation services. Craig first served as vice chairman and executive vice president of Greyhound from 1987 to 1989, when he and his partners acquired Greyhound in a leveraged buyout. When Craig returned to the company in 1994, he served as president and chief executive officer until 2003. After completing a consensual restructuring in 1995, Craig executed a turnaround plan that increased passenger volume and profits 50% and 20%, respectively, for each of six years.

Prior to re-joining Greyhound, Craig served from 1992 to 1994 as executive vice president and chief financial officer of Phoenix-based Motor Coach Industries International, Inc., the largest manufacturer of intercity coaches and transit buses in North America.

In 1980, Craig co-founded BusLease, Inc., which became the largest lessor of buses in the United States. He previously served on the compensation and audit committees of publicly traded Hastings Entertainment, a multi-media retailer in small and medium-sized markets in the western United States. Craig also served as chief financial officer and board member for Storehouse, Inc., an Atlanta-based, privately held retail chain selling contemporary furniture, and he co-founded Enginetech, Inc., an importer and distributor of automobile engine parts for the United States aftermarket.

In 2008, Craig was elected to the board of Dynamex, Inc., a publicly traded provider of same-day delivery and logistics services, where he chaired the audit committee and served on the special committee that negotiated the sale of the company in 2011. From 2006 to 2009 he served by Congressional appointment on the National Surface Transportation Infrastructure Financing Commission. Craig is on the board of directors of the Intermodal Transportation Institute at the University of Denver, where he teaches transportation systems and transportation finance at the masters level. He has completed five years as the chair of the board of trustees for The Winston School in Dallas, Texas. The Winston School serves children with learning differences in the first through the 12th grades. Craig served as an officer in the United States Air Force.

Craig is an honors graduate of Georgia Institute of Technology with a B.S. in applied mathematics and of the University of Pennsylvania’s Wharton School with an MBA concentrating in finance and marketing (top 5%).

-

Brent McCarty

Brent McCarty serves on the Board of Directors for Longhorn Health Solutions. He has more than 20 years as a senior executive in the healthcare industry, specifically in multi-site healthcare companies.

Brent is currently President and Chief Executive Officer at Sentient. He also serves on the Board of Directors for Avadyne Health, a leading provider of revenue cycle services and technology. Prior to joining Sentient, Brent was Chairman and CEO of Eagle Hospital Physicians. Previously he was President and CEO of Solis Women’s Health, a company focused on the screening and diagnosis of breast cancer. He has also served as the President and Chief Operating Officer of Accuro Healthcare Solutions, Inc., a technology-enabled revenue cycle company, and has served as Executive Vice President and Chief Operating Officer of SemperCare, Inc.

Brent has served as Chief Operating Officer for national companies in the ambulatory surgical center market as well as the physician practice management market. He began his career in healthcare with Epic Healthcare Group, an owner/operator of acute care hospitals and other ancillary services. Brent received a B.B.A. from Texas Tech University and is a Certified Public Accountant.

-

Christiana Musk

Christiana Musk is an environmental advocate who serves as an evangelist for a sustainable future. Christiana’s unique perspective as a twenty-something businesswoman landed her on the cover of Kiplinger’s and inside The New York Times, C Magazine, The Dallas Morning News, and The Herald Tribune, among others. In addition to contributing regularly to the HuffingtonPost.com’s “Green” column, Christiana is a frequent lecturer. Her speaking engagements include the Green Inaugural Ball, the Aspen Ideas Festival, the Conscious Capitalism Conference, Hollywood Goes Green in Los Angeles, and the United Nations Climate Change Conference in Bali.

She was a founding partner of Zaadz.com, an online network for people who want to change the world, which was sold to Gaiam, inc. in 2007. Her passion for social technology, global change, and empowering young entrepreneurs globally keeps her on the cutting edge of new media and emerging ideas.

Christiana inspired her father, Sam Wyly’s, environmental education, leading him to found one of the largest clean-energy companies in the country, Green Mountain Energy. This experience showed her how business can be a powerful force for change. Christiana remains actively involved in the company, and she and her father are in the process of coauthoring a book about its creation, its ongoing mission, and success.

-

Larry North

Larry North has been a leading expert in the health, fitness, nutrition, and weight loss sector for more than three decades. He has operated cutting-edge health clubs, authored three best-selling books, appeared on numerous radio and television programs, and created a globally successful weight-loss program, “The Great North American Slimdown,” that reached more than $150 million in revenue.

After advising Satori team members regarding health and wellness initiatives through the firm’s “Optimal Living” initiative, Larry found himself inspired by the principles of conscious capitalism and began to see his relationship with Satori as a continuation of his lifelong focus on impacting and enriching the lives of others.

Larry’s orientation toward others and his gift for selflessly connecting values-aligned people has resulted in the development of countless valuable personal and professional relationships throughout the Satori ecosystem.

Larry lives in Dallas with his wife, Brenda, their dog, Bliss, and their cat, Buda.

-

John Ofenloch

John Ofenloch is CEO of Ranger Wireless Holdings. He has more than 25 years of technology management experience with a focus on the telecommunications, internet services, and integrated optic manufacturing industries. His experience includes development and implementation of restructuring and business plans and strategic initiatives. He has assisted in the completion of an initial public offering, negotiated sale lease-backs, and worked on various mergers and acquisitions.

John has served in executive management roles at a photonics component manufacturing company, where he had overall responsibility for strategic planning, general accounting, treasury, budgeting, financial reporting, and investor relations. He also held management roles at a holding company that controls telecommunications operating divisions and subsidiaries in the U.S. Virgin Islands, as well as at Pacific Crossing Limited, a company that operates a trans-Pacific, sub-sea network providing a vital link between the U.S. and Asia. Additionally, he continues to serve as a director on charitable boards.

John holds a bachelor’s degree in finance from Auburn University and a Masters in Business Administration (MBA) from Southern Methodist University.

-

Cheryl Rosner

Cheryl Rosner is the founder of Stayful.com, which serves the boutique and independent hotel community. Previously, Cheryl was a strategic coach for startup founders and CEOs and a strategic advisor to BuyWithMe.

Prior to that, Cheryl served as President and Chief Executive Officer of TicketsNow, the world’s largest independent online marketplace for premium event tickets. Before joining TicketsNow, Cheryl was instrumental in leading both Expedia Corporate Travel and Hotels.com to unprecedented success. While serving as president of Expedia Corporate Travel from 2005 to 2006, Cheryl directed the group to consistent profitability, including the successful launch of two new international divisions in Canada and Germany.

Prior to Expedia, Cheryl worked at Hotels.com from 1999 to 2005 in a number of executive capacities before becoming president of the company. Cheryl’s key accomplishments at Hotels.com include: the successful IPO in 2000, the launch of the company’s consumer website in 2002 (leading it to become the sixth most-visited travel site 60 days after launch), creation and development of the company’s brand strategy, and award-winning advertising campaigns. In 2004, Cheryl was named one of the “25 Most Influential People in Travel” by Business Travel News.

-

Paul Schlosberg

Paul Schlosberg is Chairman of INCA Group LLC, a private holding company that specializes in facilitating merger and acquisition transactions, developing and executing turnaround and strategic management strategies, and creating and capitalizing corporate entities and public-private partnerships.

Paul has more than 30 years of experience in strategic business development, financial management, and organization structuring. He enjoyed over 10 years as a member of The NASDAQ Stock Market Listing Qualifications Committee in Washington, D.C. Additionally, he continues to serve actively on public, private, and charitable boards of directors. He holds the associated Audit, Compensation, and Corporate Governance positions on those committees.

In 1982, Paul joined Bear, Stearns & Co. as an Associate Director and Account Executive, during which time he established a strong portfolio of domestic and international clients. He was subsequently recruited by First Southwest Company to advance and direct the Private Client Services and Asset Management Divisions. At First Southwest, Paul was recognized for his ability to restructure, scrutinize, and fine-tune balance sheets, income statements, and corporate operations. In 1997, Paul was asked to serve as President and Chief Operating Officer of First Southwest Company and Chairman and Chief Executive Officer of First Southwest Asset Management, Inc., which concluded in his departure from the firms in mid-2003.

Paul earned an MBA from Southern Methodist University and a B.B.A. in finance and accounting from The University of Texas at Austin. He completed Corporate Board of Directors Executive Education Courses for four consecutive years at Harvard University, where he covered Audit, Compensation, and Governance issues facing boards today. He also holds additional professional licenses and designations including a number of FINRA Securities licenses. His is also is a Real Estate Broker in the State of Texas and a Certified Financial Planner.

-

Marc Sharpe

Marc J. Sharpe is the founder and chairman of The Family Office Association, an organization formed in 2007 to provide a forum for single family office principals and professionals to share ideas and best practices, pool buying power, leverage talent, and conduct due diligence.

Marc’s career in the investment management industry spans more than 25 years. He has held positions in investment banking for Goldman Sachs Group Inc. and Wasserstein Perella & Co. Inc. in addition to founding a venture capital incubator in the UK and working on strategic initiatives for Dell Inc. In 2006, Marc took a position as portfolio manager and research director for a full-service single family office serving a select group of ultra-high net worth families. After successfully navigating through the 2008 market crash, he subsequently joined an international private equity firm with assets valued at $1 billion specializing in control investments.

Marc has also served as a managing director for a boutique investment advisory firm providing alternative asset strategies to ultra-high net worth families and registered investment advisors, and he is the founder of IVY EB-5, which is responsible for building strategic partnerships and investment opportunities throughout the world via the United States’ EB-5 immigration investment visa program.

Marc holds an M.A. from Cambridge University, a M.Sc. from Oxford University, and an MBA from Harvard Business School. He is active in the Houston community and serves on the Board of the Holocaust Museum Houston, the HBS Houston Angels, and sits on the Investment Committee of two Houston-based foundations.

-

Dr. Kern Wildenthal

Dr. Kern Wildenthal has combined careers in institutional administration, clinical medicine, education, biomedical research, and philanthropic leadership. He served as President of the University of Texas Southwestern Medical Center for 22 years from 1986 to 2008 (longer than any other president of a Texas state medical school). He had been the dean of the medical school for six years before becoming the institution’s president, and prior to that he served for four years as graduate school dean. From 2008 to 2012, Kern served as the chief executive of the medical center’s principal supporting organization, Southwestern Medical Foundation, and now is the foundation’s Senior Consultant.

Kern holds appointments as Executive Consultant of ScienceSeed LLP, Board Director of the Hamon Charitable Foundation and the Hoblitzelle Foundation, Chairman of the Moncrief Cancer Foundation, and a member of the Board of Directors and Audit Committee of Kronos Worldwide, Inc., a NYSE-listed company that is a major international producer of titanium dioxide products.

During Kern’s administrative tenure at UT Southwestern, the institution more than quintupled in size and emerged as one of the leading medical institutions in the world. Four of its faculty were Nobel Laureates, 20 were members of the National Academy of the Sciences, and 50 served as presidents of national societies of their clinical and research specialties. Under his presidency, more than 300 new endowed Chairs, Professorships, and Centers were established; total endowments rose from $40 million to over $1.4 billion; land was acquired to expand the campus from 65 to 300 acres; two referral hospitals and outpatient facilities totaling 1,000,000 square feet were added to the campus; and the first half of a planned 4-million-square foot research complex was completed. The quality of the institution’s biomedical research enterprise rose in international rankings to among the top 10 in the world.

ALTERNATIVES

Our alternatives investment platform, Satori Alpha, creates and manages customized portfolios designed to meet the unique objectives of sophisticated private investors, family offices, and institutions.

THEMATIC STRATEGIES

Our thematic strategies include a public equity strategy focused on renewable energy and a business focused on companies developing innovative solutions for mental health.